Introduction to Economic Cycles: Understanding the Rise and Fall of Economies

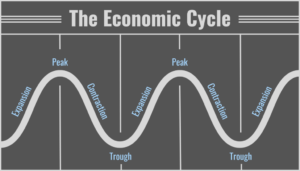

Economic cycles refer to the natural fluctuations in economic activity that occur over time. These cycles are characterized by periods of expansion, or boom, followed by periods of contraction, or bust. Understanding economic cycles is crucial for individuals, businesses, and governments alike, as it can help them prepare for and navigate the ups and downs of the economy.

The Boom Phase: Characteristics and Drivers of Economic Expansion

The boom phase is characterized by a period of economic expansion, where output, employment, and income are all increasing. This phase is typically driven by factors such as increased consumer spending, business investment, and government spending.

Countries experiencing a boom phase often see rising stock prices, low unemployment rates, and high levels of consumer confidence. Examples of countries experiencing a boom phase include the United States in the late 1990s, China in the early 2000s, and India in the mid-2000s.

In each of these cases, the boom phase was driven by factors such as technological innovation, increased trade, and government policies aimed at promoting economic growth.

Signs of a Booming Economy: Indicators of Growth and Prosperity

Key indicators of a booming economy include GDP growth, low unemployment rates, high consumer confidence, and rising stock prices. However, it is important to interpret economic data carefully, as some indicators may be misleading.

For example, rising stock prices may not necessarily reflect the health of the broader economy, as they may be driven by factors such as speculation or changes in interest rates. The impact of a booming economy on individuals and businesses can be significant.

During a boom phase, individuals may see increased job opportunities, higher wages, and greater access to credit. Businesses may also see increased profits and investment opportunities. However, it is important to note that a boom phase is not sustainable in the long term, and may eventually lead to a bust phase.

The Bust Phase: Causes and Impacts of Economic Contraction

The bust phase is characterized by a period of economic contraction, where output, employment, and income are all decreasing. This phase is typically driven by factors such as decreased consumer spending, business investment, and government spending.

Countries experiencing a bust phase often see falling stock prices, high unemployment rates, and low levels of consumer confidence. Examples of countries experiencing a bust phase include the United States in the late 2000s, Japan in the 1990s, and Greece in the 2010s.

In each of these cases, the bust phase was driven by factors such as a housing market collapse, a financial crisis, or government debt.

Warning Signs of an Economic Downturn: Identifying Vulnerabilities

Key indicators of an economic downturn include rising unemployment rates, falling GDP growth, and declining consumer confidence. It is important for individuals and businesses to prepare for an economic downturn by diversifying their investments, reducing debt, and building up savings.

Governments can also take steps to mitigate the impact of an economic downturn, such as increasing government spending or lowering interest rates. The impact of an economic downturn on individuals and businesses can be significant.

During a bust phase, individuals may see decreased job opportunities, lower wages, and reduced access to credit. Businesses may also see decreased profits and investment opportunities. However, it is important to note that a bust phase is not permanent, and may eventually lead to a boom phase.

The Role of Government in Managing Economic Cycles: Fiscal and Monetary Policies

Fiscal and monetary policies are tools that governments can use to manage economic cycles. Fiscal policy refers to government spending and taxation, while monetary policy refers to the management of interest rates and the money supply.

During a boom phase, governments may use fiscal and monetary policies to slow down the economy and prevent inflation. During a bust phase, governments may use these policies to stimulate the economy and promote growth.

Examples of successful government interventions include the New Deal in the United States during the Great Depression, and the stimulus packages implemented by many countries during the 2008 financial crisis.

However, it is important to note that government interventions can also have unintended consequences, and may not always be effective in managing economic cycles.

The Global Perspective: Examining Economic Cycles Across Countries and Regions

Economic cycles can differ across countries and regions, depending on factors such as geography, culture, and political systems. For example, countries with large natural resource reserves may experience different economic cycles than countries without these resources.

Similarly, countries with more centralized political systems may be better able to manage economic cycles than countries with more decentralized systems. The impact of globalization on economic cycles is also significant, as countries become more interconnected and dependent on each other.

For example, a financial crisis in one country may quickly spread to other countries through trade and investment channels. This can make it more difficult for governments to manage economic cycles, as they must take into account the impact of global events on their own economies.

Lessons from History: Analyzing Past Economic Cycles and Their Outcomes

Analyzing past economic cycles can provide valuable insights into how economies work, and how they can be managed. For example, the Great Depression of the 1930s led to the development of new economic theories and policies aimed at preventing future economic crises.

Similarly, the 2008 financial crisis led to new regulations and reforms aimed at preventing a similar crisis from occurring in the future. It is important to apply these lessons to current economic cycles, and to be aware of the potential risks and vulnerabilities in the economy.

By doing so, individuals and businesses can better prepare for economic uncertainty, and governments can better manage economic cycles.

Preparing for Economic Uncertainty: Strategies for Individuals and Businesses

Individuals and businesses can prepare for economic uncertainty by diversifying their investments, reducing debt, and building up savings. It is also important to stay informed about economic trends and indicators, and to be aware of potential risks and vulnerabilities in the economy.

By doing so, individuals and businesses can better navigate economic cycles and minimize the impact of economic downturns. Examples of successful strategies include investing in a diverse range of assets, reducing debt levels, and building up an emergency fund.

Businesses can also prepare for economic uncertainty by diversifying their customer base, investing in new technologies, and developing contingency plans for economic downturns.

Conclusion: Navigating the Ups and Downs of Economic Cycles

Understanding economic cycles is crucial for individuals, businesses, and governments alike. By being aware of the characteristics and drivers of economic expansion and contraction, and by staying informed about economic trends and indicators, individuals and businesses can better prepare for

economic uncertainty and minimize the impact of economic downturns. Governments can also use fiscal and monetary policies to manage economic cycles, and can learn from past economic cycles to develop new policies and regulations aimed at preventing future economic crises.